Tax Planning for Individuals with High Income

A high income individual is someone with taxable income in the top marginal tax bracket being income of more than $180,000 per annum.

Below are some specific tax planning strategies that may be of particular benefit to these individuals.

*Keep track of your records and paperwork

Taxpayers will be required to present their records in the case of an ATO review or audit in order to validate any claims they may have made throughout the financial year.

One way to do this is to keep the following documents where they can be easily found if the ATO asks for them:

- An expenses diary;

- Bank and credit card statements;

- Invoices of expenses incurred including tax invoices.

*Increase your personal contributions to your Super

Contributing to your super fund not only allows you to grow your retirement fund, but it also allows you to minimize the amount of your tax payment.

Individuals will be able to contribute up to $27,500 to their super fund in 2023, including payments made by their employer.

*Donate to DGR charities

If you are an individual who is enthusiastic about giving back to their community or specific causes, you may be able to claim your donation as a tax deduction.

It is vital to point out that only donations made to a Deductible Gift Recipient (DGR) are tax deductible. In order to check whether a charity is a DGR, click on this link.

*Obtain income protection insurance

The purpose of income protection insurance is to prepare against the loss of job income; its usefulness can be seen during the pandemic.

Income protection insurance may be able to provide support for the day-to-day expenditures in the case of an illness or accident until you are able to go back to work. Best of all the premiums for income protection insurance are tax deductible so it is best to pay for them out of your own pocket particularly if you are a high income earner.

*Using negative gearing by investing in real estate

Many people with high incomes may also own negatively geared investment properties, which are those where the tax benefits of the loss from renting them out might surpass the cash generated by the rent.

In the event that a taxpayer is negatively geared, their losses may be offset against other income, such as salaries and earnings.

*Use private health insurance to avoid paying the Medicare Levy Surcharge

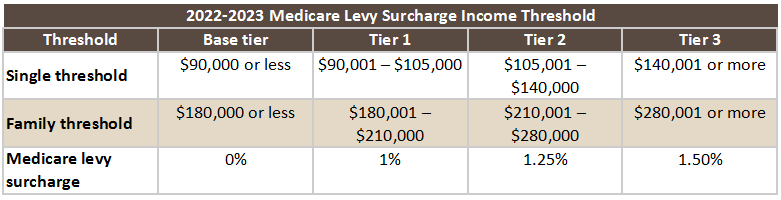

Australians pay 2% of their taxable income for the Medicare Levy—an amount paid in addition to the tax payable in order to help fund some costs of Medicare (Australia’s public health system).

The Medicare Levy Surcharge is also required of high earners who do not have private health insurance or hospital coverage.

This Surcharge, which is assessed at an extra 1% to 1.5% of an individual’s taxable income, encourages those without private health insurance to think about purchasing it and using the private health system instead.

*Obtain compensation for continuing your professional development

Improving your skills for your work through education can be claimed as a tax deductible. Some of the educational tools that may be used to lower your taxes are:

1. Training

2. Self-education

3. Professional development

*Claiming work from home expenses

We have dedicated another blogpost in this link that discusses all about how to claim work from home expenses.

*Early preparation of tax return

You can file your tax return as soon as feasible following the end of the financial year (30 June) if you keep all of your records up to date. In this way, you can be worry-free about incurring penalties and fees for late lodgment.

*Listen to an expert!

Obtaining assistance from the experts (e.g., accountants and financial advisers) can help you understand your financial position and make better decisions that can have a long-term benefit to you.

Having us prepare your tax planning with you, can give the assurance that we will work on lowering your taxes within the scope of the law to avoid heavy penalties of tax avoidance and tax evasion.

You can book an appointment with us now to have your personalised tax planning meeting!