What is Superannuation?

A superannuation fund is established as a pension plan for individuals—especially employees. Money is placed in a super account until the person retires or withdraws it. The fund in each account increases through contributions and appreciation in value of the underlying investments.

Starting from 01 July 2023, employers are expected to contribute at least 11% of the employee’s earnings into their super account.

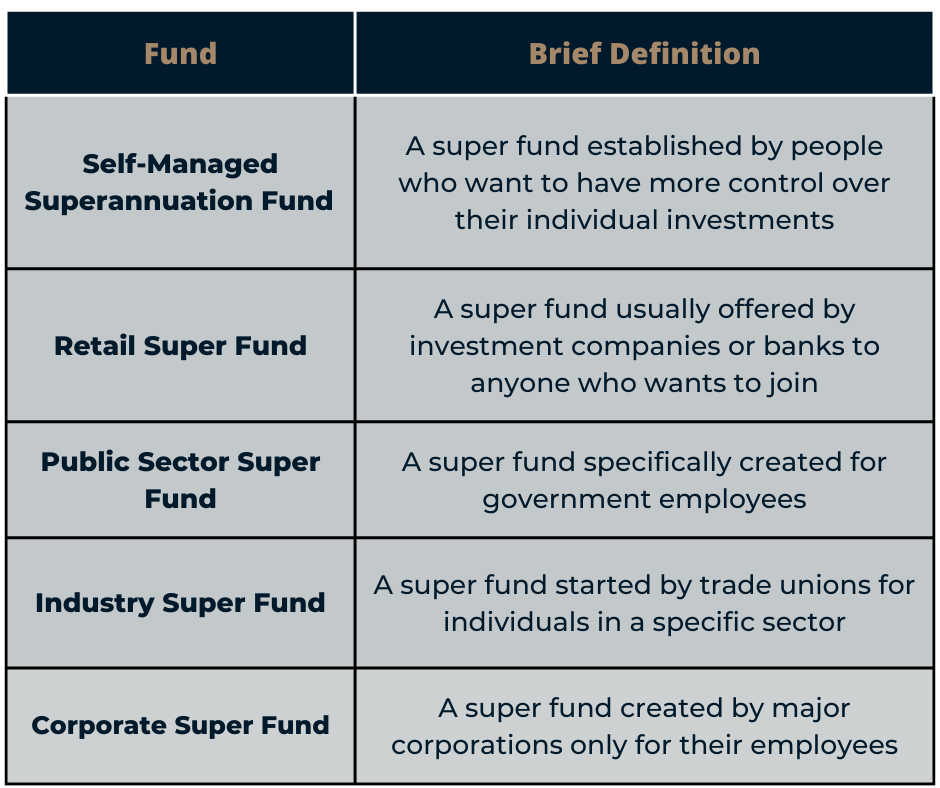

Type of fund

Here are the types of super funds currently available in Australia:

Is a Self-Managed Superannuation Fund right for you?

An SMSF is a financial product that you manage yourself to prepare for your retirement. The number of members for an SMSF is limited to six individuals—a trustee of the fund can be assigned to any member, or you can opt to get a corporate trustee.

Instead of putting your money in a regular superannuation fund, you can put it in an SMSF and have control over your investments.

Meanwhile, other super funds usually have no restriction on the number of members, and instead of choosing trustees among the members, licensed professional trustees manage the fund. Most of the time, you cannot choose the assets in which your super will be invested.

What are the risks and responsibilities of SMSFs?

Creating and managing an SMSF comes with different risks and responsibilities. Listed below are some things that members should consider:

- Personal responsibility of all members for all of the fund’s decisions—including consultation with professionals.

- The return on investments might not be the same as what was expected when the fund is originally setup.

- Relationships between members are an important factor in your SMSF—the death or illness of a member can negatively impact the fund.

- There is no access to any special compensation schemes if investment returns are low or funds are misappropriated.

How to set up an SMSF?

Here is a list of requirements to set up an SMSF if you have decided to start one:

- 1. Acquire advice from a certified financial adviser to ensure that an SMSF is the right choice for you.

- 2. Choose and appoint your trustees (individual or corporate) or directors.

- 3. Create the trust and trust deed.

- 4. Register your SMSF, get an ABN, and set up a bank account.

- 5. Start an investment strategy.

- 6. Consult with your SMSF adviser on how to manage your SMSF properly.

- 7. Properly store your SMSF records and submit them to a certified SMSF auditor.

We recommend that you see a registered financial adviser to discuss all things related to an SMSF, since setting one up is complicated.

Star Advisers is part of the NTAA SMSF Advisers Network (SAN), which means that we are one of the registered SMSF advisers in Australia. We have been helping Australians set up and manage their SMSFs.

Click on the button below to register for an appointment with us now!