Importance of upgrading your discretionary trust

Trusts are established for a variety of purposes, including privacy, estate planning, tax planning, pension funds, charities, investment trusts, and asset protection.

It is frequently misunderstood that a trust is a legal entity or person, like a company or an individual.

A trust is not a separate legal entity or person at all – it is essentially a relationship that is recognised and enforced by the courts in the context of their “equitable” jurisdiction. This fiduciary arrangement allows a third party known as the trustee to hold investment assets separately on behalf of a person or business known as the beneficiary through a trust deed created by a settlor.

We always set up a discretionary trust for a specific purpose. It can be for asset protection, tax minimisation, or family wealth accumulation.

Tax benefits of a discretionary trust

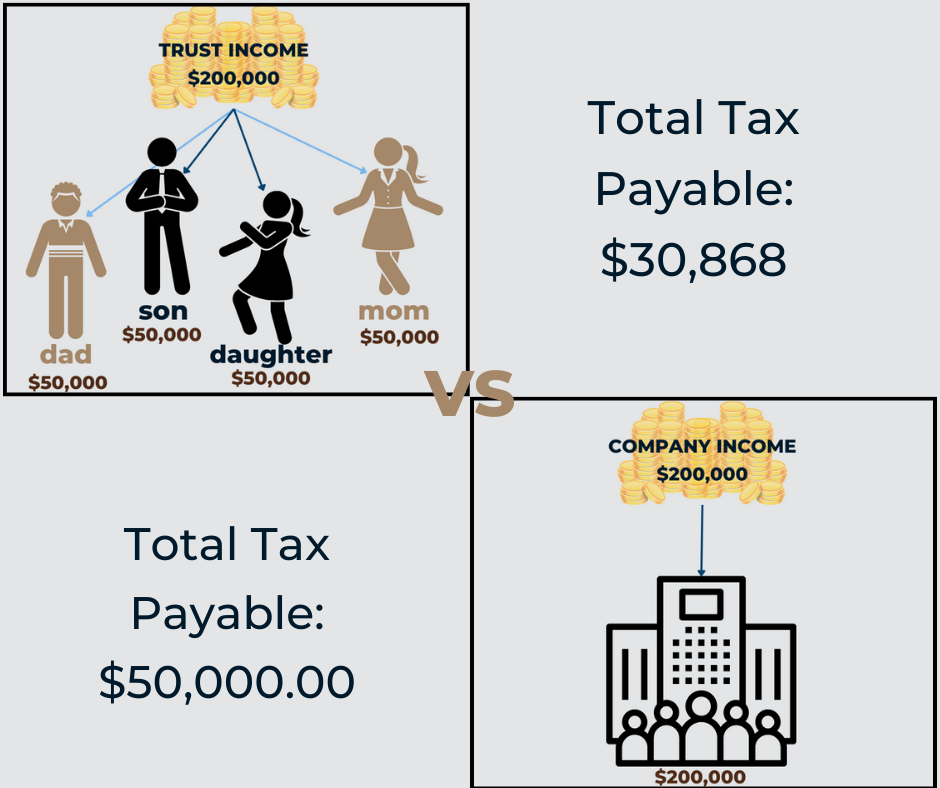

Below is a simple example that illustrates why most Australian opt to start a discretionary trust over a company.

Suppose you have a family of 4 that was operating a business. The business made a net profit of $200,000 in the 2023 FY.

If the business was operating via a trust, it could distribute $50k to each adult family member (assuming the individual has no other income for the year). Individually they would have a tax bill of $7,717 each which means a total tax of $30,868 for the family group for the year.

If however, the business was trading as a company, the company would have a tax bill of $50,000! This shows a $19,132 difference in tax for just 1 year!

So it is important to have a modern, up-to-date discretionary trust deed, just like mobile phones need updates to be better than the last version.

Here are five reasons to update your discretionary trust deed:

- Get a line of Appointors: The Appointor is the real boss behind the trust, and without a line of succession, at least two and, better still, three generations long, problems may arise if the trust is left without an appointor.

- Improved Asset Protection: It is important to ensure that there is a corporate trustee (otherwise the trustees are personally exposed to any litigation) and that the directors of the corporate trustee have successor directors in place in the event that they become sick, disabled, die, or are litigated against. The director may resign from their role, and a close family member or associate can take their place to ensure continuity of business.

- Quarantining for bloodline only: The trust you have is likely not built for the protection of bloodline beneficiaries. Upgrading the trust deed allows for additional security, ensuring your future children’s de facto partners cannot access assets in the trust in the event of separation.

- Ease of Use and Administration: Each year, the trustee must prepare detailed trust distribution minutes detailing how income from the trust is to be distributed amongst beneficiaries. Failure to distribute all income properly means that there will be a 45% tax to pay. With a modern deed tied to corresponding trust distribution minutes, the task is more effective, quicker, and less prone to costly tax penalties.

- Big changes are happening: Each state has put in place a 2% land tax surcharge on property held in a discretionary trust that does not specifically exclude foreign beneficiaries. Our modern discretionary trust deed upgrade does this and also ensures that the accounting standards changes that require expensive “financial accounts” do not apply. Both of these recent measures taken in the last year can prove extra costly.

Given all of the information you have read about trusts and our desire to ensure that our clients have the best family succession, asset protection, and estate planning structure and strategies in place, we highly recommend that we, through our partnership with Abbott & Mourly Lawyers, prepare a deed upgrade for you.

Download a copy of our e-book for more information here and click the button below to proceed with our deed upgrade offer for only $550.